In a surprise move that has caught much of the ski industry and Wall Street off guard, Vail Resorts announced on Tuesday, May 27, that longtime chief executive Rob Katz will return as CEO, replacing Kirsten Lynch effective immediately. Lynch, who had served as CEO since November 2021 and spent 14 years with the company, is stepping down but will remain in an advisory role during the transition. Katz, 58, who has been Executive Chairperson since his initial retirement from the CEO post, will also retain his position as Chairperson of the Board.

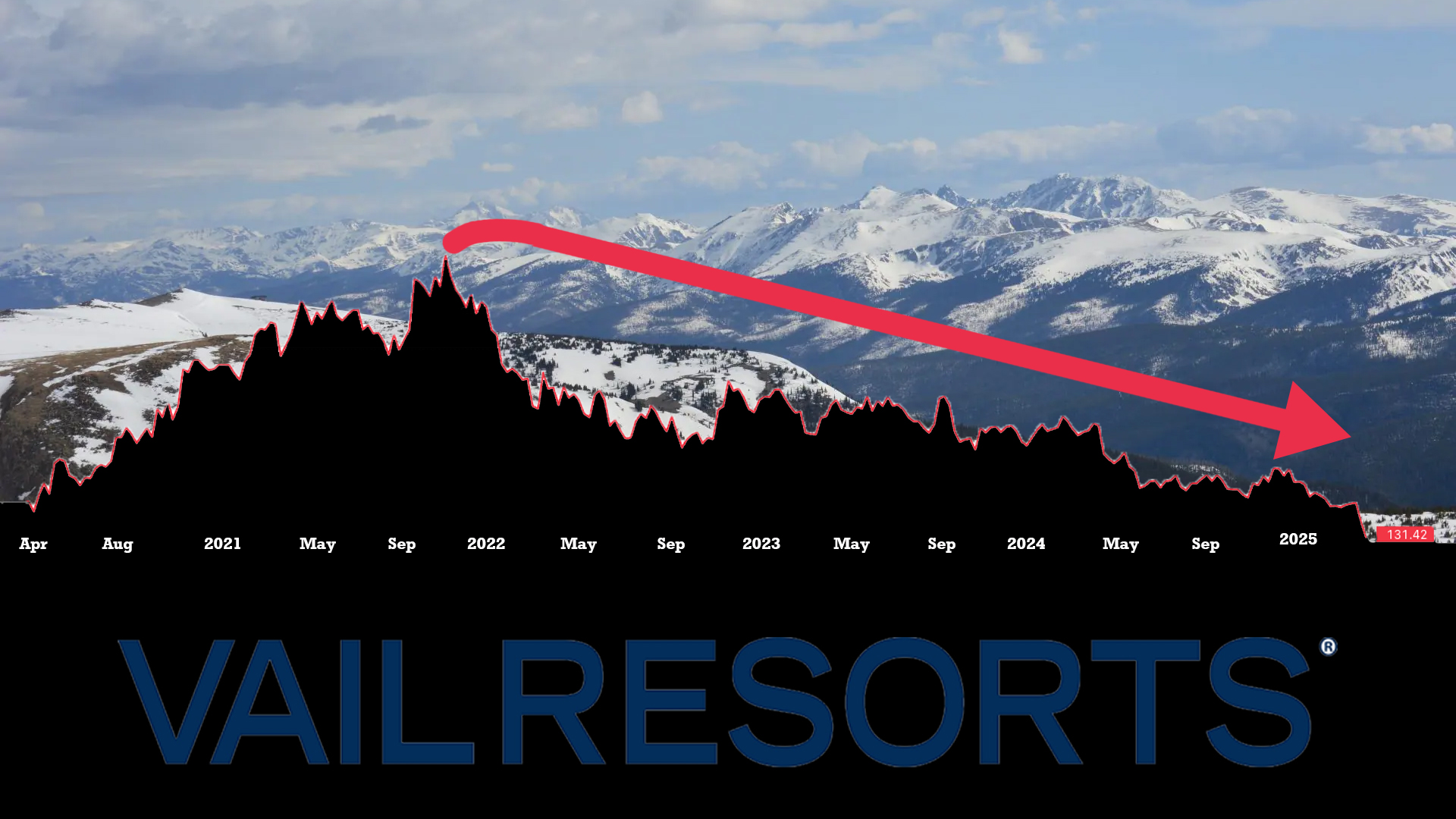

The news sparked a sharp rally in the company’s stock. Vail Resorts (NYSE: MTN), which has struggled with a declining share price for much of the past year, jumped 11% in after-hours trading—a clear sign of renewed investor confidence in Katz’s leadership. The stock closed at $151.50 on Tuesday and is currently trading at $167.29 in after hours trading (as of 6:30 p.m. ET).

The leadership shake-up comes after a bruising year for Vail Resorts on Wall Street. Vail’s share price has continued to underperform broader sector indices like the Dow Jones Travel and Hospitality indexes. On January 2, 2025, —the first trading day of the year—the company’s stock fell 6.56% to close at $175.16 following a high-profile ski patrol strike at Park City, Utah. Guests were left frustrated by long lift lines and limited terrain during the critical holiday period, and the company faced mounting criticism for its handling of the labor dispute. The stock remains down 30% over the last two years, despite recent share buybacks aimed at shoring up investor support. During its Q1 FY2025 earnings report, the company disclosed it had repurchased 0.1 million shares at an average price of $174—a move intended to create a price floor, which failed to eventuate as the share price continued its decline with a low of $129.85 in early April, falling another 25%. Vail Resorts’ shares have been struggling to regain investor confidence since peaking in November 2021 amid concerns about cost pressures, guest satisfaction, declining sales, and macroeconomic headwinds.

Katz’s connection to the company spans more than three decades. Vail Associates, the precursor to Vail Resorts, was acquired in 1992 by Apollo Ski Partners, a subsidiary of Apollo Global Management led by billionaire Leon Black. Katz, then an executive at Apollo, played a key role in the acquisition. Under Apollo’s ownership, Vail Resorts went public in 1997 and began its evolution into the dominant force in North American skiing. By 2001, Vail Resorts expanded beyond ski operations with the acquisition of luxury hotel brand RockResorts. Katz officially took the helm as CEO in 2006, leading the company through its most transformative phase—including the creation of the Epic Pass and the acquisition of dozens of resorts in the U.S., Canada, and Australia.

Katz stepped aside as CEO in 2021, naming then-Chief Marketing Officer Kirsten Lynch as his successor. While her promotion was initially welcomed as a sign of strategic continuity, analysts have since questioned whether the company’s growth strategy can weather labor unrest, inflation, and intensifying climate pressures. Lynch said it had been “an Experience of a Lifetime” to lead the company and will remain in an advisory role during the transition. Katz’s return as CEO could be just what the struggling conglomerate needs after years of stagnation, “I remain as passionate about Vail Resorts, the sport of skiing and snowboarding, and this industry as when I first became CEO nearly two decades ago,” Katz said in a statement. “I look forward to building upon Kirsten’s work and continuing our commitment to employees, communities, and shareholders.”

While Vail Resorts reaffirmed its fiscal 2025 guidance on Tuesday, it did so noting earnings are expected to come in at the lower end of its projected range. Season pass sales through May 26 remain in line with previous expectations, but uncertainty continues to cloud the company’s forward outlook. Lead Independent Director Bruce Sewell called Katz a “proven innovator” capable of leading through “industry stagnation and challenging macro environments.” Katz, for his part, expressed confidence in the company’s long-term strategy.

Vail Resorts will report its fiscal third-quarter earnings on June 5. Investors will be watching closely not only for financial performance but for signs of any strategic shift under Katz’s renewed leadership.